Australians lose $3.1 billion to scams in 2022: How can you protect your identity and money?

Scammers stole a whopping $3.1 billion from Australians collectively in 2022, according to the latest Targeting Scams report from the Australian Competition & Consumer Commission (ACCC).

The total combined losses were reported to Scamwatch, IDCARE, Australian Financial Crimes Exchange (AFCX) and other government agencies throughout last year.

Investment scams inflicted the highest losses, at $1.5 billion, while remote access scams and payment redirections scams both scored over $450 million. Romance scams, phishing, identity theft, and job and employment scams were also among the top loss categories, causing financial losses exceeding $200 million.

“Australians lost more money to scams than ever before in 2022, but the true cost of scams is much more than a dollar figure as they also cause emotional distress to victims, their families and businesses,” ACCC Deputy Chair Catriona Lowe explained.

A rundown of the 239,237 scam reports submitted to the ACCC’s Scamwatch portal in 2022, shows consumer losses rose 76% from 2021, despite a 16.5% drop in reported incidents.

Average losses, meanwhile, jumped 50% to almost $20,000, mostly due to scammers perfecting their lures to deceive targets.

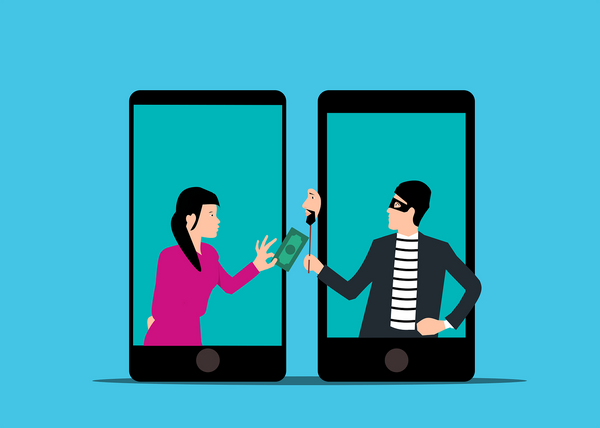

Scammers are using cost-effective spoofing technology to steal from unwary consumers, impersonating the phone numbers, email addresses and websites of legitimate businesses and organizations.

“Scammers evolve quickly and unfortunately, many Australians are losing their life savings,” Lowe said. “We have seen alarming new tactics emerge which make scams incredibly difficult to detect. This includes everything from impersonating official phone numbers, email addresses and websites of legitimate organisations to scam texts that appear in the same conversation thread as genuine messages.”

The top contact methods according to Scamwatch, include:

- Text messages – 79,835 reports

- Phone – 63,821 reports

- Email – 52,159 reports

- Internet – 13,698 reports

- Social networking – 13,428 reports

You can check the full report and glossary of scams here.

Use your intuition and stick to proper cyber hygiene to protect your hard-earned money and identity from scammers:

· Begin sharpening your scam-spotting skills. Easy money, freebies or online giveaways, and anything that sounds too good to be true are major red flags. Any correspondence offering your great investment returns or crypto should be avoided. Look up new and emerging threats and scams online regularly, and share your knowledge with friends and family.

· Think before you click. Don’t believe everything you, read, whether it’s digital threats, unusual requests for sensitive information or breaking news. Avoid clicking on links and attachments from unknown sources.

· Diligently check bills or invoices before paying. If you receive unsolicited correspondence asking you to pay shipping fees, update your payment methods for streaming services or even a road toll, independently contact the business or organization by using an official contact method (different than the one listed in the correspondence).

· Don’t rely on a caller ID or email address to determine the validity of a request. Fraudsters can easily spoof email addresses and phone numbers to trick targets into handing over sensitive information. Police or government agents will never contact you by phone, email or text and threaten you with jail if you don’t pay immediately. This is illegal.

· Add an extra layer to the security of your online accounts or devices by enabling two-factor or multi-factor authentication whenever possible, or add a PIN code, secret question or fingerprint.

· Don’t forget that a strong password is your best friend. If you need help generating and managing unique passwords for all of your accounts, check out our handy and trustworthy password manager.

· Don’t overshare online and never provide sensitive information, passwords, or codes over the phone or via text to anyone. Get in touch with the organization contacting you or head to your online account and check for any notifications.

· Be suspicious of payment methods including cryptocurrency, wire transfers and gift cards.

· Use a security solution to protect your devices from attacks and block fraudulent or phishing links before they can financially harm you.

· Immediately report any suspicious activity to your bank, credit card provider, police and online platform.

Wondering how scammers and cybercrooks get ahold of your contact information to target you with scams?

Bitdefender Digital Identity Protection can help you find out the extent of your digital identity and manage your data to avoid privacy threats by using just your email address and phone number. Subscribers also get 24/7 data breach monitoring and an awesome new superpower – the ability to uncover any social media impersonators who may ruin their reputation.

tags

Author

Alina is a history buff passionate about cybersecurity and anything sci-fi, advocating Bitdefender technologies and solutions. She spends most of her time between her two feline friends and traveling.

View all postsRight now Top posts

Fake Download of Mission: Impossible – The Final Reckoning Movie Deploys Lumma Stealer

May 23, 2025

Scammers Sell Access to Steam Accounts with All the Latest Games – It's a Trap!

May 16, 2025

How to Protect Your WhatsApp from Hackers and Scammers – 8 Key Settings and Best Practices

April 03, 2025

FOLLOW US ON SOCIAL MEDIA

You might also like

Bookmarks