Americans Lost $1 Billion to Crypto Scams in the Past Year

A new analysis from the Federal Trade Commission (FTC) reveals that Americans reported losing more than $1 billion to fraud involving cryptocurrencies from January 2021 through March 2022.

Cryptocurrency is quickly becoming the payment of choice for many scammers, with one of every four dollars reported lost to fraud paid in cryptocurrency, according to the analysis.

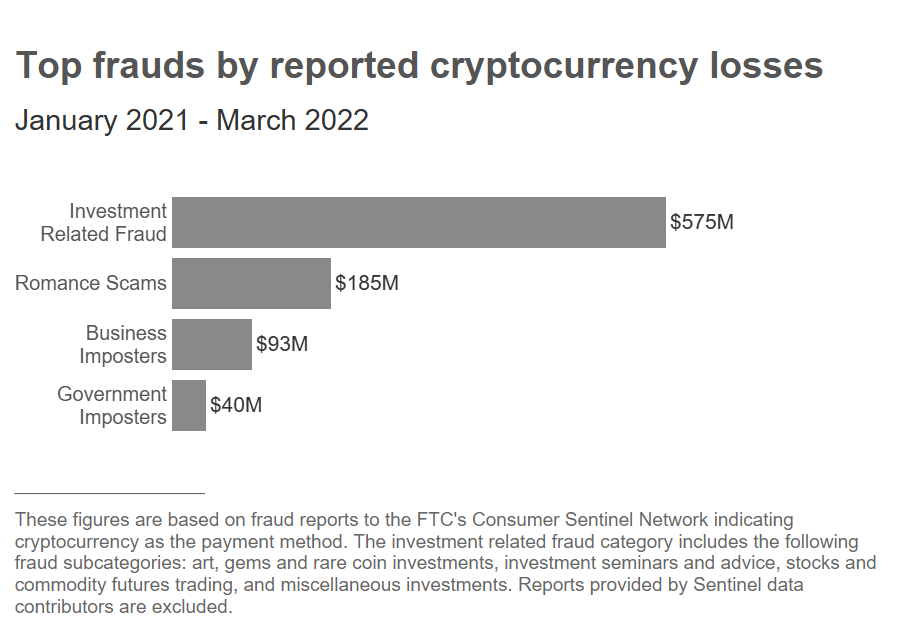

The report finds that most of the losses reported involved bogus investment opportunities, tallying $575 million since January 2021.

“These scams often falsely promise potential investors that they can earn huge returns by investing in their cryptocurrency schemes, but people report losing all the money they ‘invest,’” the FTC said.

The next largest losses reported by consumers were on romance scams and business/government impersonation scams.

“These keyboard Casanovas reportedly dazzle people with their supposed wealth and sophistication,” Emma Fletcher writes at ftc.gov. “Before long, they casually offer tips on getting started with crypto investing and help with making investments. People who take them up on the offer report that what they really got was a tutorial on sending crypto to a scammer.”

In the business and government impersonation department, citizens typically reported getting a message that claimed their money was at risk. Typical examples include:

- A text about a supposedly unauthorized Amazon purchase, or an alarming online pop-up made to look like a security alert from Microsoft. From there, victims are told they are at risk of fraud. The scammers may even get the ‘bank’ on the line to back up the story. Only the bank is not actually the bank - it’s the scammers.

- Scammers impersonate border patrol agents telling people that their accounts will be frozen as part of a drug trafficking investigation. The scammers will say the only way to protect their savings is to convert it to crypto. These ‘agents’ then direct victims to take out cash and feed it into a crypto ATM. The ‘agent’ sends a QR code and instructs the victim to hold it up to the ATM camera. The QR code is, in fact, the scammer’s crypto wallet. Once the machine scans it, the money goes to that wallet.

In another key finding, nearly half of the victims of these scams said it started with an ad, a post or a message on a social media platform.

The agency lays out three red flags to watch for:

- anyone who claims they can guarantee profits or big returns by investing in cryptocurrency;

- people who require you to buy or pay in cryptocurrency; and

- a love interest who wants to show you how to invest in cryptocurrency or to send them cryptocurrency.

The median individual reported loss was around $2,600, and the top cryptocurrencies used to pay scammers were Bitcoin (70%), Tether (10%), and Ether (9%). Readers can learn more about this phenomenon in the FTC’s full Consumer Protection Data Spotlight report (PDF).

tags

Author

Filip has 15 years of experience in technology journalism. In recent years, he has turned his focus to cybersecurity in his role as Information Security Analyst at Bitdefender.

View all postsRight now Top posts

Start Cyber Resilience and Don’t Be an April Fool This Spring and Beyond

April 01, 2024

Spam trends of the week: Cybercrooks phish for QuickBooks, American Express and banking accounts

November 28, 2023

3 in 5 travel-themed spam emails are scams, Bitdefender Antispam Lab warns

August 10, 2023

FOLLOW US ON SOCIAL MEDIA

You might also like

Bookmarks