8 Off-Season Scams Targeting Tourism Businesses, Cafés, Restaurants, and Rentals

The off-season doesn’t just mean fewer tourists and empty tables. It also creates more opportunities for scammers.

Low season is often when small business owners adjust rates, renegotiate with suppliers, update listings, push promotions, pause contracts, or plan maintenance. All of that creates more logins, more invoices, more payments, more emails, and more decisions made.

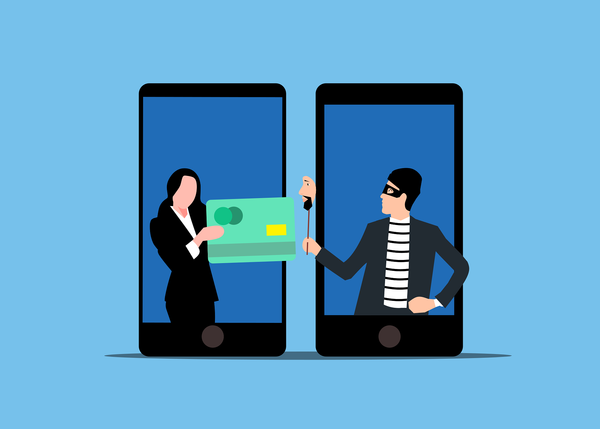

Across tourism, cafés, bars, restaurants, and short-term rentals, the most serious scams usually rely on a few mechanisms: social engineering, trust in familiar brands and channels such as in-app messages and reservation tools, and weak verification routines.

Here are eight concrete scams to beware of:

1. Fake Booking Cancellations and Refund Pressure

Cancellations naturally increase in the off-season, and scammers take advantage of that. You may receive a message claiming a guest was wrongfully charged and demanding an urgent refund. Sometimes the email looks like it came from a platform such as Booking.com or Airbnb. Other times, it appears to come directly from the guest.

The pressure is always the same: act quickly, refund immediately, and often do it outside the official platform.

During low season, when every review and every booking feels critical, it becomes easier to process refunds quickly just to avoid disputes or protect ratings.

Related: Most Common Airbnb Scams by Hosts and Guests (and How to Avoid Them)

2. Fake Platform Support Messages

Another common tactic is impersonating platform support. The message may claim there is a verification issue, a policy update, or a problem with your listing. It might warn that your account will be suspended unless you confirm your login details or click a verification link.

When bookings are already slow, the idea of your listing being suspended feels threatening. Fear makes people click first and verify later. One login submitted on a fake page can give criminals access to your real account and your guests’ data.

Related: Most Common Cyber Threats on Small Businesses and How to Prevent Them (Without Hiring an IT Team)

3. “We Want to Feature Your Restaurant” and Vanity Award Scams

In quiet months, marketing emails increase, and so do scams disguised as opportunities.

You might be invited to be featured in a travel guide, nominated for a hospitality award, or included in a “Top 50” list. The catch is usually a small fee to claim your spot, secure the badge, or confirm your participation.

In many cases, the publication does not exist, the award has no credibility, and the exposure never happens. These scams exploit a simple reality: during the off-season, businesses are actively looking for ways to attract attention and new customers.

4. Equipment, Inspection, and Utility Scams

You may receive a message about an expired POS license, a mandatory fire safety inspection fee, or an urgent refrigeration repair. In some cases, someone may even show up in person claiming to represent a utility company or inspection authority.

These scams rely on reduced staff presence and on the assumption that “someone else must have approved this.”

Related: How to Verify Utility Bills for Your Business and Prevent Payment Fraud

5. Rental Deposit and Long-Stay Booking Scams

Short-term rental owners are especially vulnerable when occupancy drops. A message from someone claiming to want a long winter stay or a corporate rental can feel like relief.

The scam often involves fake proof of payment, an overpayment that needs to be refunded, or a contract sent through a phishing link. Once money is returned or credentials are entered, the criminal disappears.

6. Fake Maintenance and Compliance Contracts

Snow removal, pest control, ventilation cleaning, and other seasonal services are common. Scammers send contracts or invoices for services that were never ordered, sometimes claiming they are mandatory municipal requirements. Confusion about regulations and compliance makes these messages sound believable.

7. Fake Travel Agency Group Bookings

A scammer contacts you, claiming to represent a travel agency or tour group. They promise a large booking, often for a bus tour or event, and send a fake proof of payment for the deposit. Then, at the last minute, the booking is canceled, and a partial refund is requested. By the time the fraud is discovered, the refunded amount is gone.

Related: How Small Travel Agencies Can Stay Safe Online

8. QR-Code Tampering in Restaurants and Rentals

QR codes are now part of everyday hospitality, from digital menus to parking payments. Criminals exploit this convenience by placing their own QR codes over legitimate ones, redirecting customers to fake payment sites.

This type of attack, called “quishing,” does not always target the business directly. Instead, your guests are the ones who lose money. But the damage still affects you, as guests rarely separate the scam from the venue where it happened. If customers are defrauded while scanning a QR code inside your venue, your brand becomes associated with the incident, even if you were not responsible.

Other Common Scams to Keep an Eye on All Year

Some threats target hospitality businesses year-round.

Fake supplier and invoice scams remain one of the most common. An email appears to come from your regular wine distributor, food supplier, or cleaning company, informing you that their bank details have changed and asking you to update payment information urgently.

Related: How to Vet Suppliers and Avoid Fake Vendor Scams

Review bombing and extortion can also escalate during the low season. A sudden wave of one-star reviews appears, followed by an offer for “reputation management services” or direct blackmail promising removal in exchange for payment. When fewer genuine reviews are coming in, negative ones stand out more and hurt faster.

Staff-targeted impersonation fraud is another constant risk. A message claims the owner has requested an urgent transfer, asks for the safe code, or instructs someone to pay a supplier immediately.

Card testing attacks are also common in tourism. Criminals use stolen credit cards to run multiple small transactions through booking engines or online ordering systems to see which cards work. In the off-season, unusual transaction patterns may go unnoticed longer if systems are not being monitored as closely.

What to Do If It Happens

No small business wants to think about worst-case scenarios, especially during the off-season. But having a clear response plan reduces panic, limits financial damage, and protects your reputation.

If guests were asked to pay via your “account”, contact the platform immediately and alert affected guests without delay. Encourage them to call their card issuer if they entered payment details on a suspicious page. Document what happened and the corrective steps you took. Clear communication helps protect your reputation and shows that you are taking responsibility, even if you were not the original target.

If you paid an invoice to the wrong account, contact your bank immediately. In many cases, funds can only be frozen or recalled within a short window. File an official cybercrime report as soon as possible and keep written records of all communication with the bank and supplier.

If you’re hit with review extortion, do not pay. Take screenshots, preserve URLs, document timelines, and report the activity through the platform’s official extortion or abuse channels.

If QR tampering occurs onsite, remove the fraudulent code immediately, but keep it as evidence. Check all other QR placements on your property. Notify your property manager or local authority if relevant, and inform customers if there is any chance they were exposed. Transparency protects trust.

If a “recovery” agent contacts you afterward, treat that as a likely second-stage scam. Recovery fraud is common after public incidents. Only work through official channels such as your bank, your payment provider, or law enforcement.

Related: Small Business Security Starter Kit: The Tools You Need and Why

Prevention is always easier than damage control, especially in the off-season. Strengthening how you secure accounts, verify payments, and monitor unusual activity can stop many of these scams before they escalate. Bitdefender Ultimate Small Business Security is designed to protect the tools and digital assets hospitality businesses rely on every day. It helps secure your business accounts and devices, monitors your business’s digital identity, and blocks scam and phishing emails before they reach you or your staff.

Try Bitdefender Ultimate Small Business Security for free for 30 days.

tags

Author

Cristina Popov is a Denmark-based content creator and small business owner who has been writing for Bitdefender since 2017, making cybersecurity feel more human and less overwhelming.

View all postsYou might also like

Bookmarks